Description

Description

- A quantitative assessment that evaluates design opportunities by linking benefit streams to associated investment costs. Based upon the results, the opportunities are either undertaken or rejected by client senior management.

When to Use

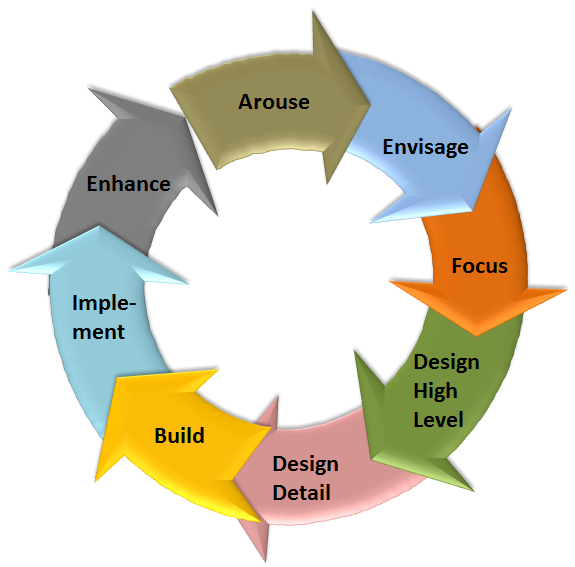

- The Cost/Benefit Analysis may be completed at several points along the BPI initiative. The points when the analysis should be completed correspond with client decisions on whether to proceed with the initiative (given the financial implications). Commonly, estimates of +/- 50%, +/- 30% and +/- 10% can be made at the end of the Focus Phase, the end of Design High-Level Phase and the end of Design Details. The criteria for deciding when it is appropriate to create a cost/benefit summary are: the size of the investment, the need for buy-in to the benefits, the accessibility of data and information from the client, and the needs of the client for financial analysis.

Approach

- Cost/Benefit Analysis can be approached from a very rigorous quantitative analysis to a more qualitative analysis. Various methods include: Cost/Benefit Descriptions, Return on Investment, Internal Rate of Return, etc. Depending on the needs of the client, it may be necessary to complete all or none of the above.

- The following steps are repeated for each iteration of the financial analysis required by the project (e.g. at varying levels of detail).

- Determine costs and benefits for identified design opportunities

- Identify costs and benefits.

- Be aware that while benefits of the design generally come from either reductions in cost or increases in revenue, other types of benefits also exist including

- Reduced rework, and associated material and people costs

- Faster billing and collections, and improved cash flow–This may be taken as a one-time benefit or as an ongoing reduction in interest expense

- Improved customer retention–Studies have shown that the cost to attract new customers (advertising, sales, etc.) is high, therefore retaining current customers can be a significant benefit

- Reduced forms and materials – These savings should be relatively easy to substantiate

- Reduced staffing – These savings are typically the most controversial and will require the most extensive analysis. Severance costs may be significant

- Improved utilisation of equipment or other assets–In some industries, improved utilisation of fixed and movable equipment and facilities due to improved scheduling or other changes may have a significant impact. Benefits can be expressed in reduced replacement cost, or reduced capital and maintenance requirements

- Costs may be segregated into one-time and ongoing expenses. Consider the following areas of costs.

- Technology costs:

- Hardware purchase, installation and maintenance (including duplicate capacity to support phased migration of systems to new platforms or technologies)

- Ongoing technical support

- Voice and data network upgrades

- Software development and support

- Software purchase and maintenance charges

- New telephone systems

- Changes in job classification and related compensation

- Recruiting and hiring costs

- Training expenses

- Performance incentives

- Cost of severance pay or retraining

- Other:

- Changes in physical facility and fixtures

- New equipment

- Identify the year in which the costs will be incurred.

- Categorise costs and benefits as tangible and intangible or quantifiable.

- Always include assumptions and sources for cost data as a part of the Cost/Benefit Analysis.

- Quantify the benefits.

- For tangible benefits, quantify them where possible in dollar terms, and assign them to the year they will be realised

- Assign a probability for the realisation of each benefit.

- Create scenarios

- Develop various scenarios based on assumptions, risks and alternative decisions. This may be based on a best-case, expected-case and worst-case scenario.

- Identify key project decisions influencing a cost/benefit realisation.

- Some decisions include:

- Funding- self funding, available funds

- Tax, asset, capital versus expense issues

- Desired profit and loss impacts

- Business drivers- critical gaps or needs i.e. “technology pill”

- Dependencies

- Identify assumptions and risks

- Costing (e.g. revenue, recurring costs, CPU, processing costs, bank interest rates, inflation, technology depreciating periods, number of users, external labour assumed rates per hour, equipment pricing and communication)

- Benefits (e.g. number of people, margins, dollar value of productivity, utilisation, and “Value” inventory turns)

- Evaluate scenarios

- Based upon the scenarios identified, compare and contrast their performance on all desired performance indicators such as present value cash flow, internal rate of return, return on investment or other techniques required by the client for project approval. Determine the quarterly impact on the profit and loss, and cash flow.

- Develop a financial analysis framework (Dupont Pyramid Analysis).

- Project costs and benefits over time.

- Identify break-even points, payback periods, other.

- Select viable scenarios.

Guidelines

Problems/Solutions

- In some cases, use outside research to complete a Cost/Benefit Analysis. For example, outside assistance may be needed to ascertain current market share and overall market growth, which could be needed as a basis for estimating growth in share and resulting revenues.

- Be aggressive in looking for tangible benefits, but ensure that the team understands and is confident about the final result. Since team members may be inclined to be conservative, become the driving force behind identifying benefits and assessing their potential contribution. The team must be creative in identifying benefits and realistic in assigning dollar amounts.

- Identify all costs associated with the project, even if they are not obvious (e.g. maintenance costs when purchasing new equipment, training costs when hiring new employees, etc.).

Tactics/Helpful Hints

- It is important to recognise the distinction between costs that are relevant (i.e. directly-tied) to any change decision versus non-relevant costs that will remain regardless of the decision (allocations of overhead costs).

- It is important to understand distinction between cost “elimination” and cost “avoidance”. Cost elimination results in a reduction of cash expenditures from an organisation, while cost avoidance refers to anticipated future expenditures that will not have to be incurred.

- When completing a cost/benefit analysis, specify the cost components of workflow, organisation, technology and other changes. For example, the $200,000 cost for a new system to manage customer orders might be broken into the cost of 15 personal computers, networking software, licenses, communication lines, outside developer cost, charges for in-house MIS development support, and ongoing MIS maintenance and support.

- Have the team present the cost/benefit information in a format that the organisation typically uses, such as a profit-and-loss impact statement, or a graphical representation of cumulative costs and benefits. Get agreement on the practices for calculating various inflation rates. Inflation or growth factors can impact payroll costs, benefits, materials and product/service prices. Find out the organisation's traditional hurdle rate and payback period for assessing investments. If this project cannot meet those standards, the team and sponsor may need to work together and with the relevant executives to package the redesign in a way that will still be economically justifiable.

- Carefully document the estimate of each cost, including any assumptions made. Some resources may be important to recognise, but may not be included as costs. These typically include internal staff time to participate in implementation activities (although many organisations elect to cost out this time) and use of equipment or facilities that may be in demand. Recognising and documenting these resources may be important to ensure that they are available, when implementation starts. Use extended team members for these activities.

Resources/Timing

- Consider using extended teams to develop detailed costs and benefits. The information systems department can assist in estimating hardware, software development and support costs. The human resources department should have data on training development and delivery costs, both from inside providers and contractors. Similarly, human resources department involvement is crucial to assessing the financial impact of job changes, recruiting, hiring, layoffs, etc. Other departments, such as purchasing, maintenance, quality assurance and various operational units may also provide needed information.

- Which processes currently provide the most value?

- Which processes should we prioritise for improvement?

- What are the high-impact, low-maturity processes?

- Who should be responsible for establishing and maintaining value-driven BPM?

- What are we doing to further develop a lasting BPM capability?

- Which processes should be locally governed, and which should be centrally administered?

- What is the business case for each proposed process improvement?

- Which BPM capabilities do I have in place, and which new ones do I have to build?

- Which processes add the most value to my business?

- Which processes are most important to focus on?

- How do I know which processes most need improvement?

- How do I assess a particular effort’s improvement potential?

- In what ways might process-improvement efforts interrelate?

No comments :

Post a Comment