Resource Management Processes

Resource management processes are business processes that provide appropriate resources to the other business processes.

Financial / Treasury Management

Process Objectives

Timely, accurate budgets and financial reports

Relevant, timely and accurate information to management

Maximise cash flow/investment earnings

Provide low cost/reduced cycle time and increased accuracy for processing activities

Optimise the entity’s capital structure

Optimise tax structure to minimise overall taxes

Comply with financing agreements/covenants and minimise financing costs

Critical Success Factors (CSF’s)

|

KPI’s Linked to CSF’s

|

Timely, relevant, accurate financial information (1,2)

Relationships with financing sources (5,7)

Efficient operations/qualified personnel (1,2,3,4,5,6)

Matching of cash requirements with forecasts (3,4)

Compliance with tax and loan regulations (7)

|

Cycle time for monthly close, “customer” satisfaction levels; information systems costs as % of sales; variances between initial close and final amounts; suspense account analysis (A)

Number/quality of financing sources (B)

Cost per vendor invoice processed; debtor/creditor days in sales/cost of sales; employee turnover rates; finance department headcounter and costs as % of respective totals (C)

Yield on investments; effective interest rate on borrowings (D)

Amendments to tax returns required; effective tax rate; default notices on covenants (E)

|

Classes of Transactions

|

Routine

|

Non-Routine

Debt issuance

Debt retirement

Accrued interest

|

Accounting Estimates

Tax accruals

Tax provision

|

Risks Which Threaten Objectives

|

Management Responses Linked to Risks

|

Inaccurate financial/management information (1,2,4)

Debt agreement/covenant violations (7)

Excessive exposure (interest, tax, counterparty) (5,6)

Mis-matched investments/debt (3,5)

Excessive tax exposure/non-optimal structure (5,6)

Changes in market conditions (5,7)

External pressure to obtain results (2,7)

|

Strong financial information systems; controls over reconciliations/suspense accounts, internal audit (A)

Monitoring of covenants (B)

Exposure reviews with “expert” assistance (C)

Treasury management system; strong cash forecasting system (D)

Tax exposure review vs external environment; “expert” assistance in tax structure review (E)

Infrastructure to track and react to market changes (F)

Review of accounting policies; audit committee oversight (G)

|

Other Symptoms of Poor Performance

|

|

Inaccessible information

Manual systems/workflow

Too many/few controls

|

|

Performance Improvement Observations

|

|

|

|

Information Management

Process Objectives

Provide integrated data processing systems which produce relevant information

Timely and accurate information processing and reporting

Control the cost of collecting, processing and distributing information

Use technology as a competitive advantage in the business

Critical Success Factors (CSF’s)

|

KPI’s Linked to CSF’s

|

Systems provide timely and accurate information (2)

Purchase and maintain systems at lowest possible cost (3)

Involve users with acquisition, development and maintenance decisions (4)

Develop integrated systems that provide cross-functionality and commonality among applications (1)

|

Information processing cycle time; user information survey results; response time for on-line request (A)

Information technology costs are percentage of total costs; cost of information technology operations vs outsourcing services (B)

Number of user complaints/requests for change (C)

Number of different software packages from different vendors; number of custom programmes vs purchased software (D)

|

Classes of Transactions

|

Routine

|

Non-Routine

|

Accounting Estimates

|

Risks Which Threaten Objectives

|

Management Responses Linked to Risks

|

The data processing systems do not provide useful information or lack adequate capacity (1,2,3,4)

Multiple software packages from different vendors prevent effective integration (1)

Inadequate training of information technology personnel (2,4)

Proper priorities not given to projects (2)

Catastrophes prevent the system from operating as intended (2)

The system lacks reliability, integrity and/or responsiveness (1,2)

Selection of a system not compatible with the Company’s needs (1,3)

|

Use of a technology steering committee (including users) to monitor utilization and adequacy of system; system development life cycle methodology that includes users (A,C)

Review software and hardware purchases to ensure they will support integration (B)

Information technology costs are compared to industry norm (G)

Cost justification analysis at project level (D)

Establish a disaster recovery plan; establish back-up and record retention procedures (E)

Review of system performance statistics (F)

Proper planning and assessment of the Company’s IT needs (G)

|

Other Symptoms of Poor Performance

|

Slow response to information requests

Users do not feel involved in development process

Many manual processes and/or paper reports

No chargebacks to departments for use

|

System is “down” frequently

Systems are too old to support integration

High level of information management operating costs

Re-keying performed

|

Limited use of PC-based applications

Users maintain own databases (not integrated)

Personnel are unproductive due to lack of skills

|

Performance Improvement Observations

|

Contingency planning

Technology benchmarking

|

Information technology strategy

Package solutions / enterprise package solutions

|

Information security analysis

Outsourcing analysis

|

Human Resource Management

Process Objectives

Attract and retain skilled and motivated work force

Control employee costs while maintaining morale and productivity

Comply with regulatory/tax filing requirements

Adherence to code of conduct

Critical Success Factors (CSF’s)

|

KPI’s Linked to CSF’s

|

Commitment to training and development (1,2)

Retention of key personnel (1,2)

Maintain competitive compensation/benefit packages (1,2)

Optimise employee utilization and productivity (2)

Employee commitment to customers (1,4)

Optimise human resource administration efficiencies (3,4)

|

Training hours per employee; training dollars per employee (A)

Employee turnover (B)

Employee turnover; compensation/benefit levels compared to the industry (C)

Sales per employee; payroll to sales (D)

Customer complaint percentage; customer surveys/focus groups (E)

Human resource employees/total employees; human resource department costs to sales (F)

|

Classes of Transactions

|

Routine

|

Non-Routine

|

Accounting Estimates

|

Risks Which Threaten Objectives

|

Management Responses Linked to Risks

|

High level of staff turnover (1,2)

Poorly motivated staff (2)

Non-compliance with regulations (tax, labour, etc.) (3,4)

Lack of personnel with skill sets needed (1)

Non-competitive compensation packages (1)

|

Conduct employee surveys with follow-up on results; implement growth and opportunity plans for employees (A,B)

Compare incentive pay to performance; conduct employee surveys with follow up on results; monitor labour relations and establish employee grievance committees (B)

Regulatory monitoring (C)

Establish formal hiring criteria; develop and implement effective training programmes (D)

Compare salary costs to industry norms; compare incentive pay to performance (E)

|

Other Symptoms of Poor Performance

|

|

High level of absenteeism

Inconsistent employee management

|

Low productivity

High level of customer complaints

|

Performance Improvement Observations

|

|

Claims systems reviews

Retirement plan reviews

|

Human resource department re-engineering

Human resource benchmarking

|

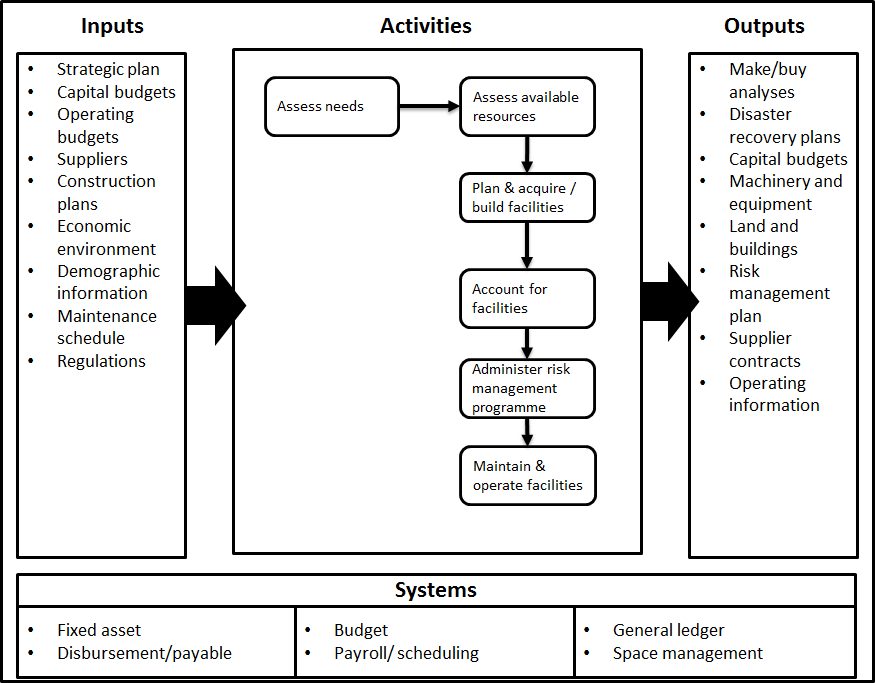

Property Management

Process Objectives

Control capital expenditures

Acquire/construct facilities at acceptable technological/reconfiguration levels

Optimise capacity

Reduce risk of loss and improve safety environment

Critical Success Factors (CFS’s)

|

KPI’s Linked to CFS’s

|

Accurately plan equipment and facilities needs (1,2,3)

Procedures to follow environmental regulations/safety training (4)

Establish maintenance procedures (1,4)

Maintain current disaster recovery plan (DRP) (4)

Establish proper procurement procedures (1,2)

Monitor developments in technology/facilities (2,3)

|

Square feet utilized/divided by total available; square feet and cost per square foot by department (A)

Ratio of insurance premium costs to coverage; number and cost of environmental fines (B)

Maintenance costs to total operating costs; equipment write-offs (C)

Modifications to disaster recovery plan (D)

Percentage of orders where discounts taken; costs per unit by vendor (E)

Equipment/technology costs by department (F)

|

Classes of Transactions

|

Routine

Fixed asset additions

Insurance expense

Depreciation expense

Maintenance expense

|

Non-Routine

Lease classification

Incentives/ abatements

Gain/loss on sale

Interest capitalisation

|

Accounting Estimates

|

Risks Which Threaten Objectives

|

Management Responses Linked to Risks

|

Insufficient or excessive capacity (3)

Uninsured or underinsured losses (1,4)

Impairment in value of assets (2,3)

Inability to acquire needed assets on time (2)

Cash flow not sufficient to fund capital expenditures (2)

No contingency plans for unexpected events (4)

|

Create and monitor facilities plans; compare costs to operate to outsourcing; compare actual utilization plan (A)

Conduct environmental and safety reviews; monitor legal and regulatory initiatives (B,C)

Monitor maintenance plans/periodic inspection; monitor new developments and technology (D)

Maintain relationships with suppliers; obtain competitive bids (D)

Monitor capital budgets; compare costs to operating budgets and industry (E)

Periodically monitor feasibility of disaster recovery plan (F)

|

Other Symptoms of Poor Performance

|

Excessive machinery downtime

Capital project overages (costs and time)

|

Manual systems / workflow

Excessive number of suppliers

|

Excessive workers’ compensation claims

Increasing property tax

|

Performance Improvement Observations

|

Procurement review

Maintenance systems review

Improved fixed asset systems

|

Property tax representation

Business incentives consulting

Management reporting review

|

Capacity review

Benchmarking study

Environmental assessment review

|

Regulatory Management

Process Objectives

Minimise litigation

Protect adequately against loss while minimizing costs

Comply with regulatory requirements

Improve environmental and safety conditions

Critical Success Factors (CFS’s)

|

KPI’s Linked to CFS’s

|

Adequate insurance with appropriate coverage (2)

Awareness training to educate against violations (1,3)

Monitor and manage environmental changes (1,4)

Maintain safe, clean, well-organized facilities (1,3,4)

Minimise and control use of hazardous materials (4)

Adequate procedures regarding lawsuit handling (1)

|

Insurance-related expenses vs prior years; amount of uncovered losses vs additional cost to cover (A)

Worker complaints; relevant training hours per employee per year (B)

Dollars spent monitoring environment (C)

Days without loss -of -work injury; workers’ compensation claims rates; dollars and number of environmental fines (D)

Measure of toxic products produced or used in production (E)

Number of new lawsuits and lawsuits settled (by type)

|

Classes of Transactions

|

Routine

|

Non-Routine

Lawsuit settlements

Regulatory settlements

|

Accounting Estimates

|

Risks Which Threaten Objectives

|

Management Responses Linked to Risks

|

Regulatory violations resulting in losses (1,2,3,4)

Settlement expenses (1)

Insurance rate increases (2,4)

Negative publicity from environmental issues (1,4)

Company is not safety/environmentally-conscious (4)

Contingent liabilities exist but are not known (3,4)

|

Monitor exam reports for violations (A)

Monitor number of new lawsuits and number settled; review total cost breakdown (indemnity, fees, etc.) (B)

Monitor insurance rates and rate “market” (C)

Track company response to issues; monitoring of competitors’ issues (D)

Establish responsibility for monitoring adherence; establish/monitor relationships with regulators (E)

Periodic reviews by experts as to conditions; monitor complaints, fines and claims (F)

|

Other Symptoms of Poor Performance

|

High or increasing average cost per case

High outside counsel costs

|

Property acquisitions without environmental due diligence

Lack of negotiated fees

|

Uncertainty as to total environmental costs

|

Performance Improvement Observations

|

Expert testimony / litigation assistance

Alternative dispute resolution

Law department review

|

Tax advice for pollution control investment

Quality assessment / compliance audits

Risk assessment diagnostic

|

Litigation management diagnostic

Environmental due diligence

Environmental benchmarking

|

No comments :

Post a Comment